As part of Fantom’s continuous evolution toward decentralization, we are proud to bring to a governance vote for the future of fUSD, Fantom’s native stablecoin. After extensive conversations with various teams, we have found that the OINDAO team is ready to provide a solution: they propose to take over the management of fUSD and help migrate fUSD holders over to their collateralization model.

If this change is implemented and fUSD fails to maintain a stable peg (>20% of its value) for more than two cumulative weeks, another governance proposal will be implemented for the network to vote on whether a new team should take over fUSD or whether the previously elected team should continue.

Please find below a series of Q&As with the OINDAO team to provide further clarity on their fUSD deployment plan.

- Why is OIN best positioned to do this on Fantom?

We provide a turnkey solution to a protocol’s stablecoin needs. In addition to deploying a stablecoin issuance protocol, we are focused on integrating the product into Fantom and building utilities within the ecosystem.

OINDAO - a robust CDP-based stablecoin minting platform:

- OINDAO - a unique crypto-backed stablecoin with a unique Stability Pool to aid liquidations. The Stability Pool provides the resources for liquidations, and distributes proceeds of the collateral to the stakers. Users take staking rewards and liquidation proceeds from staking the minted stablecoin into the Pool

- The Stability Pool leads in: 1. Speed, efficiency, and deployability of settlement funds in liquidations 2. Democratization of liquidation (in addition to bots and institutional funds, ordinary users can now also have access to low-risk liquidation profits)

- Built with future multi-chain composability in mind, but with the intention to maintain chain-specific autonomy and to keep risks on different chains segregated

OIN Finance - an experienced stablecoin team:

- Track record of working with reputable investors and partners (with audited deployments) such as Harmony, NEAR, with more upcoming such as Aurora, Moonbeam, and others unannounced

- The long-term plan is to enable cross-chain stablecoin bridges and explore a meta-stablecoin that links all OIN stablecoins together, creating a connected & seamless experience across different applications. Also allows us to target integration with enterprise solutions.

- Benefits and value created will be recaptured and kept within the ecosystem. e.g., protocol revenue generated on Fantom will be distributed to OIN token holders on Fantom, and chain-specific governance decisions will also be made exclusively by OIN token holders on that specific chain

- What method will OIN use to keep peg?

Outside of traditional peg-keeping mechanisms of collateralized stablecoins (e.g. overcollateralization, arbitrage, etc.), we maintain 4 main pillars to the peg.

-

Maintain a deep fUSD stablepair liquidity pool to minimize slippage via liquidity incentives

-

Stability Fees are charged per stablecoin minted per block. This controls the money supply akin to a central bank’s interest rates, growing or constricting supply, thus the “price”, and thus the peg

-

The Stability Pool provides 2 main mechanisms - 1. Locks fUSD in staking contracts to decrease a possible selloff, 2. If the fUSD rises above $1, stakers in the Stability Pool may take less gains from liquidations, or even incur losses. This incentivizes them to unstake, increasing the amount of fUSD in circulation and potentially arbitrage through DEXs until the peg is restored; The opposite happens when the price is too low

-

Cap on total issuable stablecoins controls the max circulating supply that can prevent overselling due to leverage. Can be adjusted via governance, and is dependent on the depth of the stablepair liquidity pool

-

What benefits will this bring to the Fantom network and its validators?

Key benefits to the Fantom network: 1) a unique crypto-backed stablecoin protocol that is native to Fantom, but well positioned for a multi-chain future; 2) The fUSD brand will be maintained, and the token price will be tightly pegged to the USD; 3) It allows protocol revenue, risks, and governance all kept within the Fantom community, but still maintaining future potential for multi-chain composability.

Key benefits to Fantom validators: the Fantom Foundation will direct its liquidation profit it gains during the initial liquidity bootstrapping period to the special-fee-contract (SFC). In addition, OINDAO normally takes 2% from liquidation profits to the system Treasury, 50% of which will now also be directed to the SFC on Fantom to ensure a strong community establishment of the fUSD on Fantom. This arrangement will apply to all vaults that take FTM-related tokens as collateral, including staked FTM, wFTM, and FTM-related ibtkns, but exclude non-FTM related tokens, such as LP tokens.

- What does OIN see as the biggest risks to taking on this endeavor?

There are three obvious risks that are inherent to collateralized stablecoins and blockchain projects:

-

System solvency

-

Fluctuation of the dollar-peg

-

Security

Key risk mitigation levers we implement:

-

System solvency risk is mitigated through OINDAO’s proven dual-step liquidation mechanism. It is worth mentioning that the recent market crash arrived in less than 1 week since our deployment on Harmony. The system still remained solvent and maintained high liquidation efficiency throughout the recent events.

-

The peg is managed as detailed in question 2, and backstopped by the value of the underlying assets and liquidation mechanisms. They provide a floor for the inherent value of the stablecoin, giving arbitrage opportunities to savvy users.

-

Our smart contracts have been audited by CertiK and Slowmist. New versions are independently audited by different auditors to ensure that nothing is overlooked, and each version is secure. We will also implement a bounty programme for our system.

-

How will OIN migrate current fUSD holders?

Our concern mainly lies in current fUSD holders that have purchased fUSD at a higher price, and are now waiting for the price of fUSD to return to its peg. Our plan is to incentivize fMint users to repay their debt first. This should reduce the supply of the original fUSD in the market and in turn pushes up the price of the fUSD closer to its peg, reducing disruptions to the people that purchased fUSD.

Migration plan should involve the following steps:

-

FTM Foundation to make official announcements that cover the following topics:

-

The transition and changes to be made to the old system (see detailed proposed changes in Q8)

-

Advantages of the new system

-

Encourage the community to pay back when the price of fUSD is still attractive (at the time of writing ~$0.57)

-

Stop the 6% APY that goes out to vaults with 500%+ C-Ratio

-

OIN to educate the community on how to navigate the new system, liquidity incentives, upcoming plans via AMAs, partnerships, announcements, and articles

-

Will OIN provide liquid staking?

No, we will not provide liquid staking for the following reasons:

-

We want to remain focused on collateralized stablecoins

-

Stablecoin projects have a high requirement for the liquidity of the underlying collateral, therefore liquidity incentives will be required to ensure a strong 1:1 peg for sFTM-FTM, a task big enough for a standalone liquid staking project.

-

We believe in protocol composability. Synergies between projects are stronger than one large project on a protocol.

We will however, explore partnerships with liquid staking solutions on Fantom e.g., taking in the liquid staking token as collateral.

- What is OIN’s timeline for deployment?

OIN will be able to deploy 2 to 3 weeks after a governance decision has been made.

This time will be used for gathering logistics e.g., liquidity, as well as community announcements and engagement.

- Please provide an in-depth overview of OIN’s fUSD implementation (long forum):

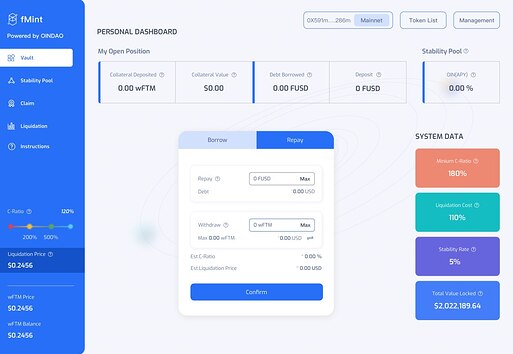

System UI

The new system will be positioned as a new co-branded fMint system that’s powered by the OINDAO. The system UI will also be customized to Fantom blue, see below example:

Collateral

The new system will initially accept wFTM as collateral. The system will explore additional collateral types such as liquid staking tokens, interest-bearing tokens, and LP tokens.

Key criteria for accepting new collateral would be i) existing liquidity of the collateral; ii) demand for the collateral; iii) volatility of the collateral

Future collateral will be added based on decisions of the Fantom community once OIN begins DAO governance.

Stability Pool incentives

To encourage some users to become Stability Providers to help maintain system solvency, 2% OIN tokens will be initially allocated to the Stability Pool as incentives.

Liquidity incentives

We are negotiating with DEXs to provide liquidity incentives for the initial 2 months.

We will apply for the Fantom Incentive Programme, and allocate 80% of the incentives received to fund the subsequent incentives.

In addition, starting in May-June 2022, OIN will begin DAO governance. ~20% of total OIN tokens will be allocated to each network that the OINDAO is deployed on proportionate to the total volume of the stablecoin minted. The tokens will be distributed on a weekly basis for a duration of 3 years. OIN token holders on each network will be able to vote on where to allocate the weekly distribution.

Liquidity bootstrapping support needed from Fantom Foundation

We ask the Foundation to support us with $2m (in FTM & USDC) to help us bootstrap the initial liquidity. The liquidity will stay in the Foundation wallet, and will be used to help us to maintain a relatively strong system solvency and dollar peg from the very beginning of implementation.

We propose the following breakdown for the liquidity:

- Total liquidity support: $2m($1.714m FTM + $286k USDC)

- fUSD-USDC liquidity: $572k (this would need $714k FTM to mint 286k fUSD at 250% C-ratio and $286k USDC)

- Stability Pool: 400k fUSD (this would need $1m FTM to mint 400k fUSD at 250% C-ratio)

Changes that will be made to current fUSD model

We also ask the Foundation to make the following adjustments to the existing fMint system as operational support for the migration:

Discourage minting of the (old model) fUSD by:

1.1 Adjusting the borrowing fees to 100%

1.2 Terminating 6% APY rewards for vaults with C-Ratio above 500%

Encourage repayment of the fUSD by:

2.1 Announcing that UX support for fMint will be terminated in 3 months -

2.2 Activating interest rate module (if applicable)

2.3 Activating liquidation module (if applicable)

- Monitor the fUSD price by:

3.1 Being prepared to step in with fUSD supplies in case of market price manipulation in the repayment process with the old fUSD

It is now up to you, the fantom community, to determine whether this change goes into effect.

To vote on the proposal, please head to https://fwallet.fantom.network/, and find Proposal #19 in the Governance tab.

The OIN team will host an AMA on March 22nd, 11:00AM EST. For further announcements, please follow them on Twitter @FinanceOIN.