Exactly that! We already have a 10x increase in throughput, already real world, and we have greater planned. We believe segmentation makes things more difficult for our dapp developers.

I am looking forward to seeing how account abstraction works out in the long term. In the meantime, I know fWallet has been getting redeveloped.

Would you consider adapting it into a native EVM browser extension similar to metamask rather than a pws webapp?

Also how do you feel about the current state of browser wallets, what do you like and what would you like to see them improve on?

Can’t comment much on fwallet sadly, that’s not my department.

I believe wallets will become more abstracted and eventually completely obfuscated, closer to how we experience social auth today, but still a bit away from that as it needs some inherent browser changes.

Hello Andre,

Just read the article on Account Abstraction & and the new paths it opens (like Economic Abstraction).

“Since a wallet under the Account Abstraction implementation is a smart contract, many other functions become available. Most importantly, economic abstraction becomes viable, which is the ability for users to pay transaction fees in tokens other than FTM.”

How this availability to pay in other token will interact with the current structure of the token burn and especially the Vault ?

If account abstraction allows people to use crypto other than Fantom on the Fantom network, will that decrease the use of the networks coin?

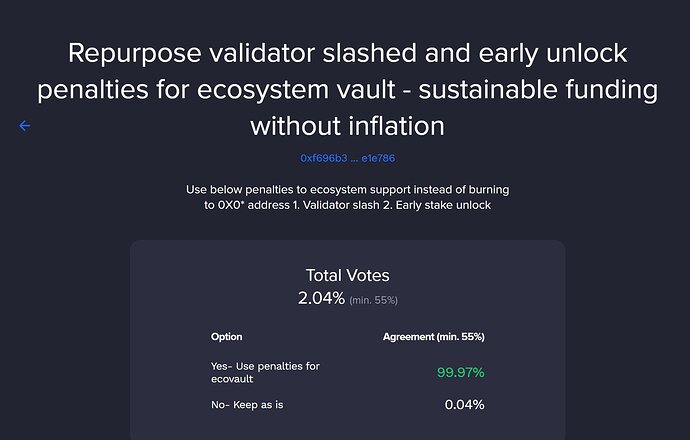

Can slashed ftm from validator double signing etc and early unlocking go to a ecosystem vault(or to any purpose driven vault) instead of sending it to 0x00 burn address? - one more avenue to capture value for the ecosystem without inflation of token…

Btw great presentation at Quantum Miami - especially last part on how you came up with number 10.

Hey Andre. I have gone through some of the fUSD post.

When fUSD was introduce it was an experiment. Ppl mint fusd at very low price than a dollar. Most of the time 40-50 cents only. Now if they have to pay back the dollar for each fusd given what market condition we are most likely small user won’t be able to repay.

Unfortunately they will be rekt by this exercise.

Ethical would be the repay amount in USD should be the borrow amount in USD.

Current it is double. Not everyone has game the system by borrowing fusd most of them are just noobs user.

Economic abstraction simply changes the point in which payment occurs. In the default model gas is subtracted at the start of the transaction, under account abstraction the gas is subtracted at the end of the transaction. This allows economic abstraction via two methods;

- Subsidizer can pay on behalf of and take another coin in trade (OTC trade)

- Executor can include a swap from token x to native gas

This can be implemented, good candidate for a proposal on the forum, want to make an official proposal?

fUSD has always been minted at a price of $1, the debt for 1 fUSD is $1. fUSD did not control the secondary market, so if minters sold their fUSD for less than $1, they sold at a loss.

As you say, repay amount in USD should be borrow amount in USD, this is exactly what it is.

Sure, will do, thank you

Few counter-view

- fusd minted at price of 1$. Does it guarantee 1$? Ans it was never. Just putting a text label 1$ in frontend doesn’t make a token to stable coin. Foundation after launching fUSD never paid any heed to stable the fUSD.

- Minter sell at the loss because this is the only choice they have. They can only buy wFTM from fUSD at a loss. Foundation never warn the user in bull market about liquidation of staked FTM. If warning was there most of the ppl avoided these things.

- Help the user to repay. It’s like foundation gave 40 cent in bull market and asking a 1$ in bear market.

- Crypto is already not being very nice to us in last year.

- Lastly, honest intent is to repay only but if it’s not practical for user to pay how would they?

You are mixing the minting / debt mechanism with the secondary markets. fUSD = $1 of debt, whenever you mint 1 fUSD you take on $1 of debt. This has no correlation with secondary markets. The minting mechanisms has no control over secondary AMMs, if the minter of fUSD decided to sell fUSD for lower than $1, they made that choice of their own accord, they could have simply paid back the fUSD debt. The minting mechanism also only requires the debt to be repaid, so if 100 fUSD was minted, it requires 100 fUSD to be repaid. The mechanism itself is simple, irrespective of what the minter decided to sell or purchase fUSD for.

i understand what you are saying is correct from theory point of view. But when you see practical out of it doesn’t make sense. Mint fUSD and do nothing. Anyway if foundation give any thought about how the user can repay without costing them entire stack will be a good solution.

Hi Andre,

Will there be a mechanism to swap/migrate fusd v1 to v2? For those of us bagholding fusd, would the only option available be to sell at the best price we can on secondary markets, since the fusd swap amm you’ve made only allows trading from DAI to FUSD?

Nothing planned at this time, best to simply close out your position.

Dear Andre,

Will you add ftm liquidity to solid on etherum, can you explain why will you do it or why not?.

I just want to learn from the economic point of view. I have got any bag of solid just a fantom holder.

Thank

Hi Andre

I believe through this forum our voices can be heard by the top management. Initially there was another plan suggested for liquidations of fusd where all early minters debt would be locked and not liquidated and for new minters (since they already know about liquidations) they will follow the new liquidations rules suggested by you. Can this option be opted or you can suggest a better plan in which both early minters and new minters can be safeguarded. I mean mostly long term investors are the old ones and they user the minting service as per the instructions mentioned that their stake will stay locked till ratio climbs up. There should be some safe way suggested for them. I believe its just a matter of waiting a little till FTM price recovers and all shall be equal for everyone by lpaying their debts.

Just a request if the management can atleast reconsider it and think over some plan for existing minters since one safe plan was suggested by fantom team which wasnt put through the voting. Otherwise everyone was happy with it.

As a very early investor - I also agree with Samad. I used the mint feature to double down on my FTM investment, and increase the amount I could stake in order to secure the network (which I totally agree, was 100% my choice). If liquidations are enabled with anything close to the current market conditions, I too will also get rekt.

Would love it if we can find some middle ground solution that protects old investors that minted under the “old rules” of locked, not liquidated, but also lets new minters play by the “new rules”. Perhaps for v1 sFTM backed minters, the liquidations “activate” once current C-Ratio goes above 300%?

Also open to any other ideas (if there’s any possibility of something like this), but something that protects and gives ample time to early investors that minted under different rules and market conditions to close their position with minimal chances of reckage would be massively appreciated!